Access funding under the UK Government’s Growth Guarantee Scheme, designed to support viable businesses with asset finance and business loans. The scheme provides lenders with a 70% government guarantee, increasing access to finance and improving borrowing

Asset Finance under GGS

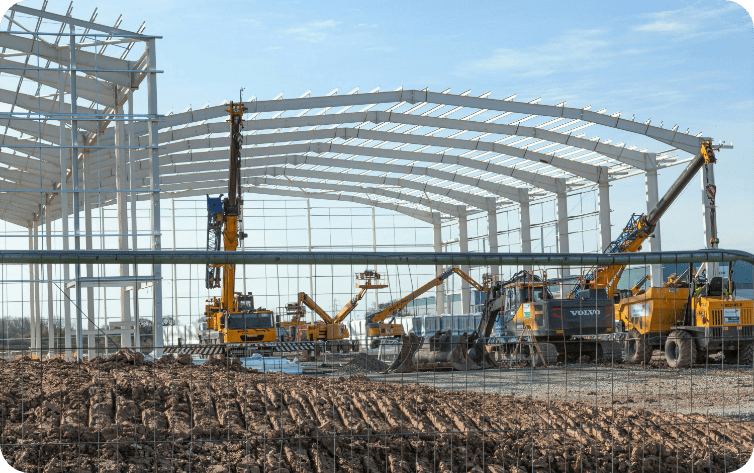

Access government-supported asset finance to invest in vehicles, machinery, or equipment, preserving capital and improving cash flow.

Business Loans under GGS

Secure growth funding backed by a government guarantee, helping to strengthen borrowing terms and increase access to capital.

A structured repayment plan where you own the asset at the end of the agreement. Ideal for businesses investing in long-term plant, vehicles, or machinery.

Use the asset for a fixed period while making regular payments, with the option to continue leasing or upgrade at the end of the term. Suited to businesses looking for flexibility and tax efficiency.

A vehicle finance option offering lower monthly payments and the choice to purchase, return, or refinance the asset at the end of the term.

We offer a range of asset finance solutions, including hire purchase (with VAT deferral options), leasing, and refinancing. Whether you’re looking to acquire new equipment, vehicles, or machinery, we can tailor a solution that fits your business needs and cash flow.

With hire purchase, you own the asset at the end of the agreement. Our VAT deferral option allows you to delay paying the VAT upfront, helping you manage your cash flow more effectively. This is particularly useful for businesses looking to preserve working capital while acquiring essential assets.

Leasing allows you to use an asset without owning it. At the end of the term, you can either return, upgrade, or extend the lease. Hire purchase, on the other hand, leads to full ownership once all payments are made. The right choice depends on your business goals and tax considerations.

Yes, we offer unsecured and secured business loans for working capital, expansion, or other business needs. Our VAT loans help spread the cost of your VAT bill over manageable monthly payments, reducing cash flow strain.

We understand that speed is crucial for businesses. Many of our finance agreements can be approved within 24–48 hours, depending on the complexity of the deal. We work closely with our lending partners to ensure a smooth and efficient process.

Yes, we offer seasonal payment plans to help businesses with fluctuating income manage their repayments more effectively. This is particularly beneficial for industries like agriculture, tourism, and construction, where cash flow varies throughout the year. With seasonal finance, your repayment schedule is tailored to align with your peak earning periods, reducing financial pressure during quieter months. Speak to our team to find out how we can structure a finance package to suit your business needs.

We are your trusted finance provider, providing competitive rates and flexible repayment terms with quick approvals and streamlined documentation.

Company Address: Magbiehill Park, Dunlop Road, Stewarton, Ayrshire, KA3 3ES

Company No: SC790558

ICO Reg No: ZB641777

Allied Business Finance Limited is an independent asset finance brokerage not a lender, as such we can introduce you to a wide range of finance providers depending on your requirements and circumstances. We are not independent financial advisors and so are unable to provide you with independent financial advice. Allied Business Finance Limited will receive payment(s) in the form of commission from the finance provider if you decide to enter into an agreement with them. We work with both discretionary and non-discretionary commission models. Commission payments are factored into the interest rate you pay.

Allied Business Finance Limited is an Appointed Representative of AFS Compliance Limited which is Authorised and Regulated by the Financial Conduct Authority FRN: 625035

Allied Business Finance Limited aims to provide our customers with the highest standards of service. If our service fails to meet your requirements and you would like to report a complaint; please click on the link below: Complaints – AFS

Website by Creo Design, a part of The Solutions on Demand Group.