Thinking about upgrading your car, but don’t want to pay a huge amount upfront? You’re not alone. More and more UK drivers are choosing Personal Contract Purchase (PCP) to make switching to a newer, safer, more efficient car both affordable and flexible.

PCP is one of the most popular ways to finance a new or used vehicle because it offers lower monthly payments and gives you several end-of-agreement choices. If you like driving something modern every few years without the commitment of full ownership, PCP could be ideal.

In this guide, we’ll walk through what PCP is, how it works in practice, and what to consider before signing up—and help you decide whether it’s the right option for you.

What Is PCP Car Finance?

Personal Contract Purchase (PCP) lets you spread the cost of a new or used car over a fixed period—usually two to four years—without paying for the full value of the vehicle.

Instead of financing the entire cost, you only pay for the portion the car is expected to lose during your agreement (its depreciation). Because of this, monthly payments are typically much lower than alternatives like Hire Purchase or personal loans.

At the end, you decide what to do next, giving you control and flexibility.

Why So Many Drivers Choose PCP

PCP has grown rapidly in popularity because it combines affordability with choice. Here are the key reasons drivers prefer it:

1. Lower monthly payments

Since you’re not financing the full price of the car, payments are usually far smaller than traditional finance. This often puts newer or higher-spec models within reach.

2. Choice at the end of the agreement

Unsure whether you want to keep the car long-term? You don’t need to decide upfront. At the end, you choose whether to buy it, return it, or upgrade to something new.

3. Easy upgrades

PCP makes it simple to switch into a newer model every few years. If the car is worth more than the figure guaranteed at the start, you can use the difference (equity) towards your next car.

4. Predictable monthly budgeting

Fixed payments make it easy to manage your finances with no sudden surprises.

5. No hassle selling your car

If you decide to hand the car back, you simply return it—no need to advertise, negotiate, or worry about depreciation.

What Can PCP Be Used For?

PCP is a flexible form of car finance that can be used across a wide range of vehicles and driver needs. Many people choose PCP for brand-new cars, as it offers an affordable way to enjoy that fresh, modern feel without paying the full purchase price upfront. It’s also a popular option for nearly new or approved-used vehicles, giving drivers more choice and often better value while still benefiting from lower monthly payments.

If you’re thinking about switching to electric or hybrid motoring, PCP can make the transition easier by spreading the cost while technology, battery range, and charging networks continue to develop.

Whether you’re upgrading the family SUV, choosing your first car, or considering an eco-friendly EV, PCP provides a practical and cost-effective way to drive the car that suits your lifestyle and budget.

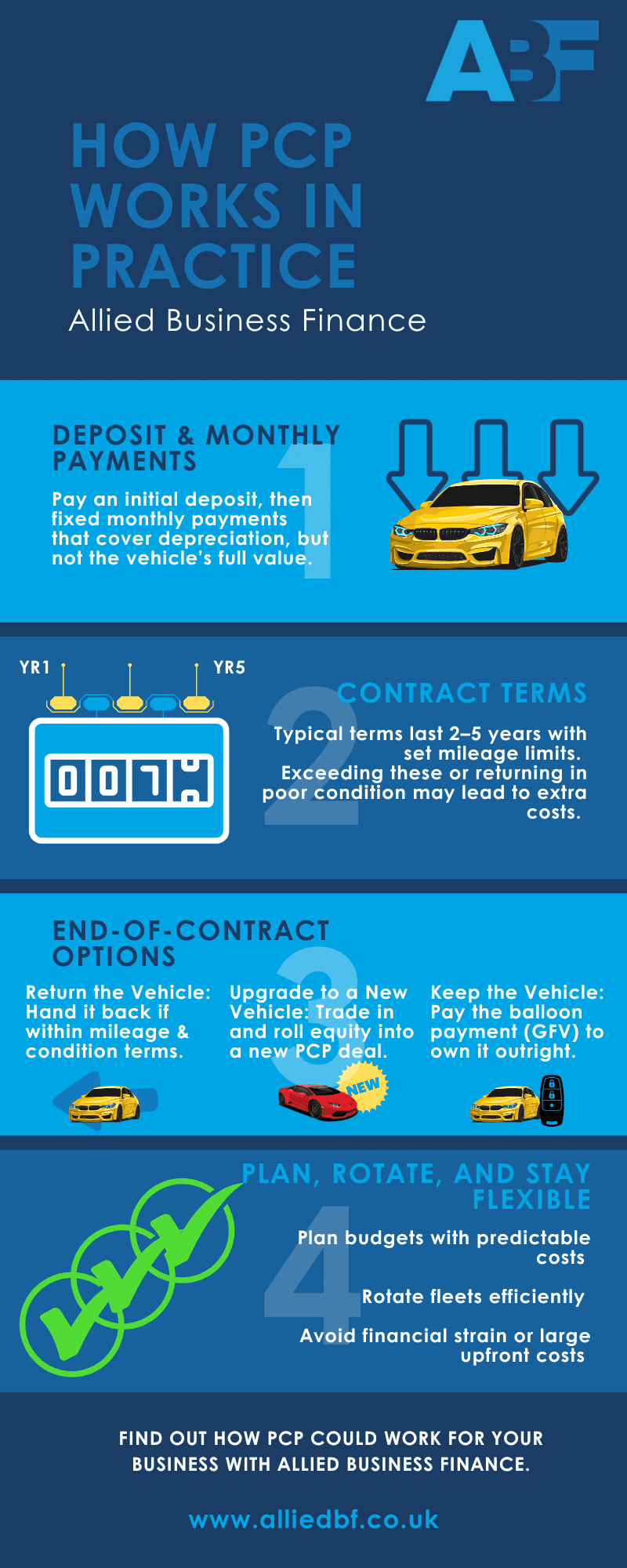

How PCP Works in Practice

A PCP agreement has a few simple components:

A PCP agreement has a few simple components:

Deposit and term: You start with a deposit, choose how long you would like to fund the vehicle over and set a mileage limit that reflects your predicted annual usage (e.g. 10,000 miles per year).

Monthly payments: Your monthly payments cover the car’s estimated depreciation during the term. A Guaranteed Future Value (GFV) is set at the start; this is calculated using industry valuations (e.g. CAP) which estimate what the car is expected to be worth at the end of the term and set mileage limit.

End of term options: When the agreement ends, you can choose to:

- Return the car – hand it back and walk away, provided mileage and vehicle conditions are within the set limits. Vehicles handed back that have exceeded the mileage limit set will incur a pence per mile charge for every mile over. This charge is written into the agreement.

- Trade it in – if the car is worth more than the GFV, use the equity as a deposit on your next car.

- Buy the car – pay the final balloon payment and keep it.

Mileage and condition: Your mileage allowance helps calculate the GFV. If you exceed it or the car has excessive wear and tear, there may be charges; so keeping the car in good condition helps avoid extra costs.

Is PCP Right for You?

PCP can be a great fit, but it depends on your driving habits and what you want from your car.

| PCP may suit you if: You like changing your car every few years. You want a newer or higher-spec car for lower monthly payments. You prefer flexibility rather than committing to ownership. You value predictable, fixed monthly costs. | PCP may not suit you if: You drive very high mileage each year. You want to own the car outright from day one. You don’t want to worry about keeping the car in good condition. |

For many drivers, PCP offers the ideal balance – modern cars, manageable payments, and freedom at the end.

A Quick Example: How PCP Might Look

If you choose a £20,000 car with a £2,000 deposit and a four-year PCP:

- The lender sets a Guaranteed Future Value of £8,000 based on your predicted annual mileage.

- Your monthly payments cover the £12,000 in depreciation and interest costs.

- At the end, you choose to return the car, upgrade using any available equity, or buy it outright by paying the £8,000 final payment (GFV).

The Bottom Line

Personal Contract Purchase (PCP) offers a smart way to drive a newer, safer, more reliable car without large upfront costs or committing to long-term ownership. With lower monthly payments, clear end-of-term options, and predictable budgeting, it’s one of the most flexible and accessible ways to finance your next car.

Find the Right PCP Deal for You

At Allied Business Finance, we make car finance simple. Our team can help you compare options, understand the costs, and find a PCP deal that fits your budget and driving habits.

Email [email protected] or complete our quick contact form, and one of our specialists will guide you through your options.

Drive smarter. Spend wisely. Finance confidently – with Allied Business Finance.

And don’t forget, if you want to learn more about asset finance and its various forms, we’ve already covered:

Follow us on LinkedIn, Facebook, and Instagram to stay up to date with Allied Business Finance.