Asset finance provides an affordable, secure line of credit; allowing companies to invest in tangible assets, from office equipment to manufacturing plant, from vehicles to entire fleets.

There are several forms of asset finance, including Hire Purchase (which we covered in an earlier blog). In this post, we take a closer look at Leases, and in particular, Operating Leases – a flexible and efficient way for businesses to access the assets they need without large upfront costs or full ownership responsibilities.

In today’s fast-moving industries, the ability to upgrade equipment regularly can be the difference between leading the market and falling behind. Operating leases allow companies to stay agile by maintaining access to the latest vehicles, machinery and tech without being tied to ageing assets or unpredictable resale values.

What is a Lease?

A lease is a formal agreement between a finance company (the lessor) and your business (the lessee). The lessor buys the equipment or vehicle from the supplier, and your business pays regular rentals for the right to use it over an agreed term.

The asset remains on your balance sheet for accounting purposes, and you record the payments as expenses in your profit and loss account. During the lease, your business is responsible for insuring and maintaining the asset, as well as meeting any usage or return conditions set out in the contract.

If payments are missed, the finance company may have the right to repossess the asset, so it’s always important to understand the agreement fully before signing.

There are two main types of lease; a Finance Lease and an Operating Lease. We covered Finance Leases previously, so in this blog, we will focus on Operating Leases.

What is an Operating Lease?

An Operating Lease lasts less than the asset’s useful life, and the finance company does not recover the full cost of the asset during the term. Instead, the finance provider assigns a residual value (RV) – the estimated resale value at the end of the lease – which reduces your monthly payments.

The lessor retains ownership and bears the risk associated with the asset’s residual value. This makes Operating Leases particularly suitable for assets that retain strong resale value.

In many cases, additional services; such as maintenance, servicing, or replacement, can be built into the agreement, helping businesses manage costs and reliability over time.

A true Operating Lease has several key features:

- You only finance a percentage of the total cost of the asset, as the lease includes a Residual Value.

- The Residual Value may not always be stated in your agreement, but can usually be provided on request.

- Ownership always remains with the finance company – there is no option to purchase the asset at the end of the term.

You must be able to return the asset at the end of the lease, in the condition specified in the documentation (‘Return Conditions’).

Who uses Operating Leases?

Operating Leases are widely used across industries and sectors, and in the 12 months to August 2025, Operating Leases accounted for £10.4bn of funding in the UK, up 4% year on year, according to the Finance & Leasing Association (FLA).

Furthermore, Fleet News reports that operating leases represented nearly 90% of van fleet funding in 2024, a clear sign of their dominance in the commercial vehicle market.

Beyond transport, operating leases play a crucial role in the education, manufacturing and technology sectors.

In Education, schools and colleges often use Operating Leases to fund ongoing equipment investment for IT, science labs or classroom equipment. In fact, they’re the only type of lease that local authority-controlled schools and academies are legally allowed to use.

Manufacturers use them to stay competitive by accessing the latest production equipment, while construction firms rely on them for plant and machinery that might otherwise require significant upfront investment. Even tech and creative companies utilise operating leases to refresh servers, laptops and audio-visual equipment every few years to ensure reliability and efficiency whilst keeping costs predictable.

Operating leases are also becoming increasingly popular among green-conscious businesses, especially those investing in electric vehicles or energy-efficient machinery. Leasing enables companies to stay aligned with sustainability targets and adopt new technologies faster, without the long-term risks of ownership.

How does it work in practice?

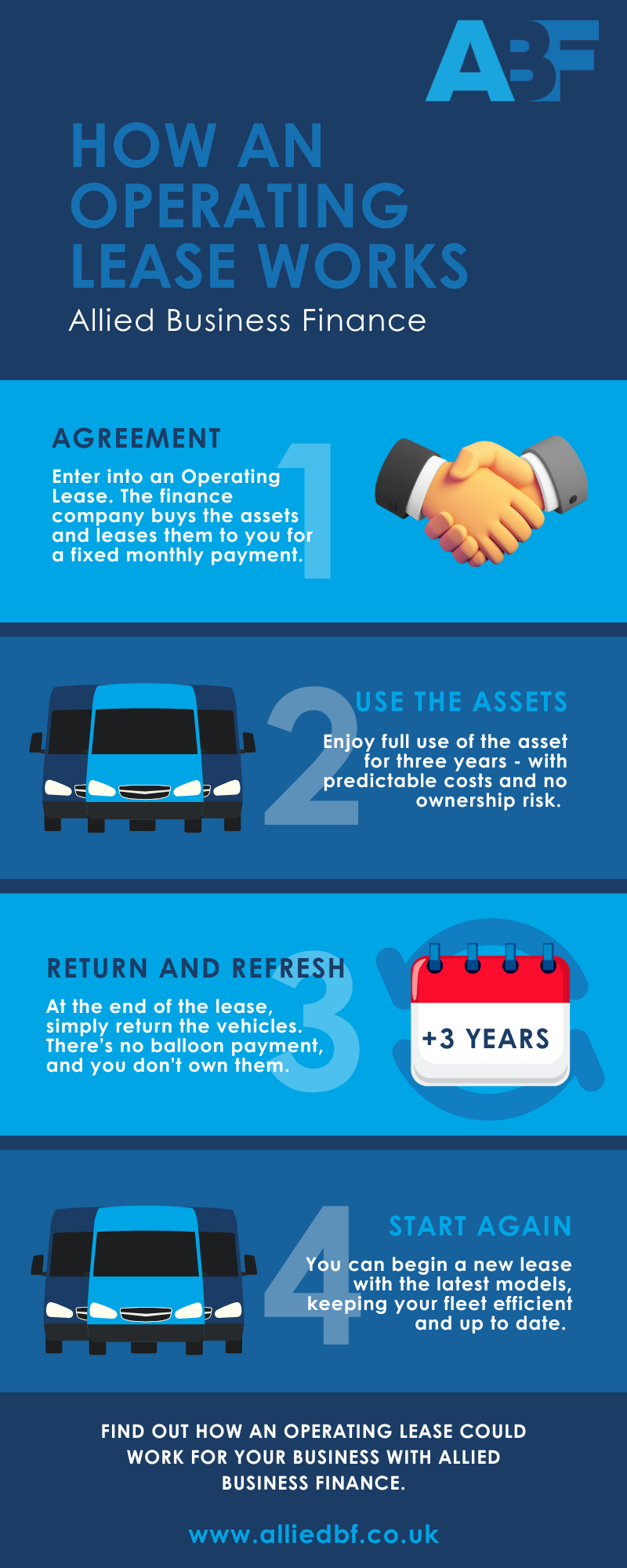

Let’s say your business needs a new fleet of delivery vans. Instead of buying them outright, you enter a three-year Operating Lease with a finance company for a fixed monthly payment.

Let’s say your business needs a new fleet of delivery vans. Instead of buying them outright, you enter a three-year Operating Lease with a finance company for a fixed monthly payment.

At the end of the three years, you simply return the vehicles — there’s no balloon payment, and you don’t own the vans.

You can then start a new lease for newer models, keeping your fleet modern, efficient, and reliable.

The same principle applies whether you’re upgrading IT systems, installing new production equipment, or replacing agricultural machinery.

You gain full use of the asset without tying up valuable capital or worrying about future resale values

Is an Operating Lease right for you?

An Operating Lease could be ideal if your business:

- Wants access to the latest equipment or vehicles without the cost of ownership

- Prefers lower monthly payments compared to hire purchase or finance leases

- Operates in a fast-moving industry where regular upgrades are essential

- Needs predictable, fixed costs for easier budgeting

- Would rather keep the asset off the balance sheet (in certain cases)

However, if your business wants eventual ownership of the asset, or if the resale value is less relevant, then Hire Purchase or a Finance Lease may be more suitable options.

Please refer to your accountant for more details on the tax treatments for different forms of business finance.

The Bottom Line

Operating Leases give businesses flexibility, freedom, and control. You can access the equipment and technology you need to stay competitive – without locking away your cash or taking on the risks of ownership.

By spreading costs and regularly upgrading your assets, you’ll keep your business efficient, agile, and ready for growth. The ability to refresh assets every few years ensures that your team always has the best tools for the job; improving performance, safety and sustainability.

In short, an operating lease can turn asset finance into a strategic advantage. It’s not just about funding, it’s about future-proofing your business.

If you’d like to explore how an Operating Lease could work for your business, get in touch with us at Allied Business Finance by completing the short contact form, and one of our specialists will be happy to help.

And don’t forget, we’ve already covered:

Asset Finance – what it is and why it could be the smartest way to drive your business growth

Hire Purchase: A Simple, Flexible Way to Fund Growth

Finance Lease or Buy? Understanding Your Asset Finance Options.

We’ll also be covering PCP and Refinancing in an upcoming blog. Follow us on LinkedIn, Facebook, and Instagram to stay updated.